Payroll errors negatively impact profitability and lead to wasted time in HR and employee dissatisfaction. Payroll errors are unfortunately common - especially in startups - but fortunately preventable.

The good news is you can avoid most payroll mistakes and errors. Our practical 15-point payroll performance checklist will help you identify areas for improvement.

Download our FREE payroll guide to learn about:

Mistake-Free Payroll: Download Now

Click the links below to go directly to the topic error of your interest*:

Payday and its impact on your business

The Great Resignation and quiet quitting

The 8 biggest payroll mistakes

How to avoid payroll mistakes: 5 practical solutions

Payroll performance checklist

HR technology vs. employee retention

*The information, data and guidance provided in this guide is for general information purposes only and does not constitute professional or legal advice.

Paydays are much more than financial tasks and bank transfers. They can evoke emotions from pleasurable chills and excitement to bitter disappointment.

No wonder: making an income is the main reason most individuals seek paid employment.

As a result, paydays:

What can happen if you pay your employees late or underpay them by mistake? If your employees’ (lack of) income affects their security, it will impact their productivity. They can even consider quitting.

Therefore, make sure that your staff are satisfied with what they’re paid and how they’re paid.

It goes without saying: payday is directly related to profitability and the success of your business. Thus, managing your payroll in a smooth, smart, and fair way is critical.

The Great Resignation is a shortcut for the historical quit rate happening on the job market as a result of the coronavirus pandemic. Many employees are deserting jobs they don’t enjoy, where they don’t feel respected, or where the work doesn’t fit in with their personal lives.

The term “quiet quitting”, in turn, refers to employees who show up at work to do the bare minimum. According to some people:

Quiet quitting is a trendy new name for worker dissatisfaction and lack of engagement.

Therefore, even though the recent “Great Layoffs” are getting a lot of attention, they don’t represent the overall job market. We may be living during the economic downturn, but many employees continue to leave their jobs or “quit quietly”.

Improve your employee engagement and retention with HR Calendar & Planner 2023!

HR Calendar 2023: Download Now

According to numerous employment and HR statistics, employees are searching not only for a paycheck, but also for joy, happiness, respect, flexibility, and healthy employee experiences. Employers must address these needs so they don’t put their companies at risk.

What is essential for employees in the Great Resignation?

Compensation is still the most crucial factor for employees. However, like never before, employees value work-life balance, flexible schedules, advancement potential, and the ability to work remotely.

The Great Resignation has various consequences for businesses and HR departments, for instance:

To attract and keep the right talent, companies must offer employees a positive onboarding and workplace experience.

Therefore, make sure your staff is satisfied with what and how they get paid, but also make time to address other needs. In other words, treat your employees holistically. To make time for that, you can’t waste time on manual, repetitive work and processes that tools can do.

For this reason, payroll has a critical role in employee retention. It’s also an area where you can automate unnecessary work. The right HR & payroll provider will help you achieve that.

Payroll mistakes result from poor payroll processes. Payroll processing includes various tasks, such as entering data into payroll software, calculating wages, or processing payroll taxes.

In short, it's about ensuring employees get paid correctly and on time. Unfortunately, this is not something employers are capable of getting right every time and/or in every case, according to various payroll statistics, facts, and data.

Let’s start with the most common payroll errors and mistakes. Then we’ll discuss the ways of solving and preventing them.

Imagine if salespeople spent a lot of their time managing documents and processing orders instead of pursuing sales. It wouldn’t take long to see the impact of this on the company’s bottom line.

Now think about HR & Payroll departments and consider:

Never-ending manual work that wastes too much time and resources: this is the world of payroll in many companies.

Entering, verifying, and managing payroll data manually is tedious and time-consuming. Unfortunately, the impact of this excessive manual work is usually more difficult to spot compared to hard numbers in sales departments.

However, wasted time in HR has a long-term impact on your company’s profitability, especially at a time when retaining employees can be hard.

The truth is that your HR should focus on what counts: your employees. HR should focus on building a happier workplace where “employee turnover” sounds like a foreign word.

Therefore, to reduce manual work and paperwork in HR, consider creating a payroll master file for automation. It will free up time for strategic HR activities and boosting employee engagement.

In today’s business world, we’re increasingly dealing with complex payroll transfers (vs. regular monthly transfers). For example, consider the complexity of calculating pay for freelancers, hourly employees, or frontline workers earning different amounts at different times.

The bottom line: in complex payroll cases, many things can go wrong. As a result, it’s much easier to miscalculate pay and make payroll errors than ever before.

Unfortunately, it often takes only 2 payroll errors for an employee to start looking for another job. Thus, you don’t want to mess up with someone’s pay.

49% of US workers will start looking for a new job after experiencing only 2 problems with their paycheck.

The Workforce Institute, Kronos Incorporated

Payroll errors cost companies money and time and lead to employee dissatisfaction. Still, companies paying their employees late and/or incorrectly is common.

Based on the survey by SD Worx:

Miscalculating pay can result in:

Employee misclassification is another common and costly payroll error, especially when working with freelancers or independent contractors.

Businesses can’t afford to tolerate incorrect payments and poor payroll. First, checking and correcting your calculations is usually costly and time-consuming. Second, your employees identifying payroll errors themselves is a red flag:

If payroll errors occur, fix them promptly so you minimize employee dissatisfaction and avoid penalties. Unfortunately, low-performing organizations can take around 5-10 days to resolve a payroll error (APQC).

For this reason, instead of taking your precious time to resolve payroll errors, do your best to prevent them from happening.

With the right payroll services, payroll teams can identify problems that may negatively impact the payroll cycle’s completion. This way, they can solve them before the payroll is run.

Modern payroll services help to:

Payroll processes are relatively straightforward when employees on permanent contracts receive the same salary every month. But, as already mentioned, more complex payroll cases are rising.

They're especially common in fast-growing startups and in the gig economy sector (a.k.a. digital platform work) that is constantly growing.

Currently HR and payroll processes are well-suited for unchanging things in a stable world. However, such a world doesn’t exist and we’re operating in increasingly volatile environments. From the payroll perspective, it’s not the world of straightforward payroll transfers and calculations anymore.

Piotr Smolen, Co-Founder at Symmetrical

Complex payroll cases require flexible systems and technology capable of handling multiple variables, as well as systems that address modern complexities and can process the fast-changing payroll data.

That said, it’s worth investing in payroll technology to get your payday right.

Consider this. Flexibility is a top factor that could prevent employees from leaving an employer. Thus, many employers cite flexible workplaces as their top retention strategy. They’ve started experimenting with different solutions to address labor shortages.

For instance, to make jobs more appealing, some retailers offered to pay store workers daily rather than weekly. To provide flexible pay like that, a flexible payroll solution is a must.

Flexibility is also required when companies expand globally and hire remote employees. Keeping track of the latest employment regulations, taxes, and policy changes in different countries is critical. For this, you need a smart and flexible system to ensure you stay compliant in non-standard situations and at all times.

Download our Gig Economy Guide to save money, stay flexible, and prepare your company for the future of work!

Staying on top of payroll-related deadlines is critical. No company wants to mess with paying salaries or payroll taxes.

So first, you must pay your employees on time. Otherwise, they’ll lose trust in your company and will consider quitting.

Do you employ freelancers and other gig workers? Remember that it’s a deal breaker for many gig workers if they don’t get paid almost immediately. The effectiveness of payroll processes has an enormous impact on that.

Symmetrical’s payroll solution can benefit the gig sector and significantly reduce waiting time for pay. As financial liquidity is important for all employees, this significantly improves employee satisfaction.

Second, be careful about missing tax deadlines. Otherwise, it can cost your business a lot of money, employee dissatisfaction, and legal trouble. You must also pay the correct tax rate and remember that they’re subject to change.

To learn about the remaining payroll errors and mistakes, download our FREE payroll guide.

Mistake-Free Payroll: Download Now

In today’s dynamic workplace reality, it pays to avoid outdated HR and payroll systems. Choosing accurate, flexible, and adaptable systems is even more important when your business and workforce are growing.

Here are some actionable recommendations to help you avoid payroll errors.

Ensure your payroll process works smoothly, and your system is flexible. Remember to meet important deadlines or to send forms on time. Most payroll solutions have alarms and reminders to help you avoid missing important details.

Go through and spring-clean your existing records. Use a proven system to gather all the relevant details about your employees.

Use a payroll effectiveness and efficiency checklist to identify any potential glitches.

Ensure your payroll admin has all the necessary data, and processes to handle the payroll process properly.

If you have doubts about the accuracy of your payroll-related matters, e.g. records and deductions, consult payroll experts (HR & payroll specialists, accountants, tax consultants, etc.).

If payroll problems/errors occur, resolve the issues immediately. If necessary, report them to relevant entities.

In the case of minor payroll errors, you can usually do one of the following:

Always do your best to prevent and spot payroll errors before they happen. Using human eyes and processes alone for this may be too risky. So consider investing in HR & payroll software.

If you have access to payroll software, run a few key reports before processing payroll. This will help you catch and prevent mistakes.

Consider running the following reports:

Furthermore, to prevent payroll errors:

HR and payroll need better data for better decisions. Unfortunately, HR departments have lagged behind in this regard.

According to the study by Capita Resourcing:

Luckily, AI and automation can help with a big data gap in HR. AI can help HR professionals analyze key data and identify trends as well as pain points. This way, issues can be addressed proactively.

For instance, high resignation rates among employees from particular departments or pay grades can highlight the areas that need particular focus.

There is a strong link between payroll and HR. Together, they can gain an excellent collective understanding of their employees and what makes them want to stay or leave (whether pay-related or not).

Before taking steps to change or improve your payroll system, you must understand the effectiveness of your current process. Honest answers to some crucial questions are a good starting point.

Check out the payroll performance checklist below.

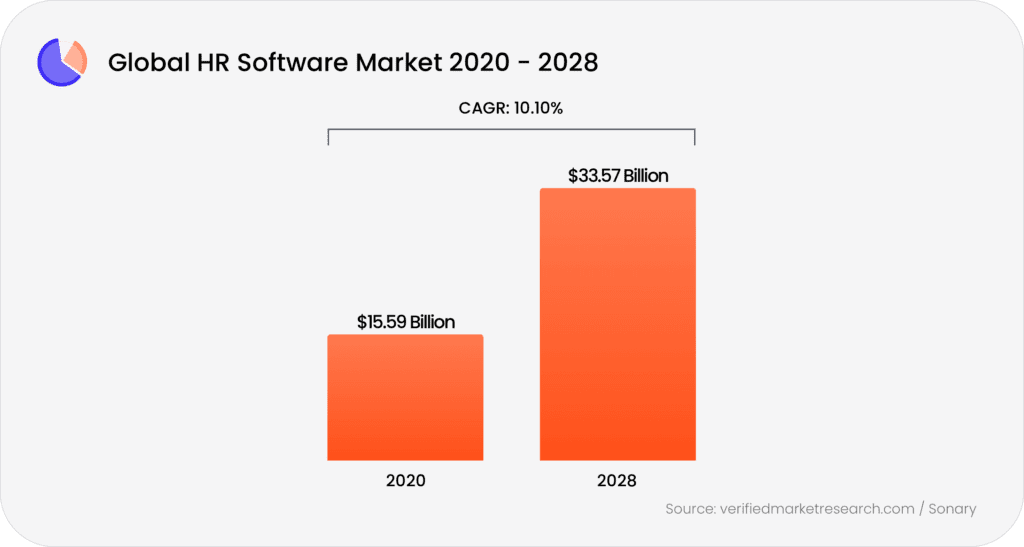

HR technology is a hot topic. First, the global HR software market is growing. Second, the significance of technology in HR is growing.

Automation and AI help HR by improving core processes as well as interacting with employees. For example, chatbots are a good way to provide immediate answers to common questions employees ask about general organizational processes.

Furthermore, employees expect self-service capabilities in the current climate. People want to have access to essential documents like payslips and own their personal information.

This is not to say automation should entirely replace human interaction. Quite the contrary, automation should help with specific (usually repetitive) tasks so HR departments have more time for those that require the human touch.

This is essential in the time of the Great Resignation (quiet quitting), but also in the economic recession.

Technology can’t replace the human touch and human interactions. However, it can help make work more human by freeing up time for what matters.

Consider automated payroll. It can help attract and retain talent by:

More than 33% of business owners still use spreadsheets to manage their payroll. But there’s an alternative to this outdated and inefficient manual practice.

Creating a payroll master file for automation will help you:

Make time for the things that count. Think about how you can automate repetitive tasks to be there for your employees when they need you.

Employee retention in this unprecedented market is the top challenge for many HR departments. They need more innovation and automation, and payroll is one area that can be a game changer.

The right payroll service ensures you pay your employees accurately and on time. It helps you reduce payroll mistakes to a minimum. It also addresses changing employee needs by giving employees more freedom and flexibility.

The right payroll solution makes payroll management easy. Automation combined with expert support makes things easier.

Symmetrical offers easy, automated payroll services with the support of a dedicated team of payroll experts to help you:

8 Must-Have Benefits of Automated Payroll

Common Payroll Mistakes

How Global Payroll Can Meet the Challenges of the Great Resignation

8 Definite Benefits Of An Automated Payroll System

6 Ways Global Payroll Can Meet the Challenges of the Great Resignation

What to Expect Post the Great Resignation in 2023

Automated Payroll: Benefits

Employee Payroll Records

HR automation in 2023

69% of UK workers ready to move job

Is salary important to workers?

The Risks of Poor Payroll for Businesses

Top 5 Ways Payroll Automation Will Benefit Your Business

7 Ways Payroll Automation Is Beneficial for HR

How to Prevent Common Payroll Processing Mistakes